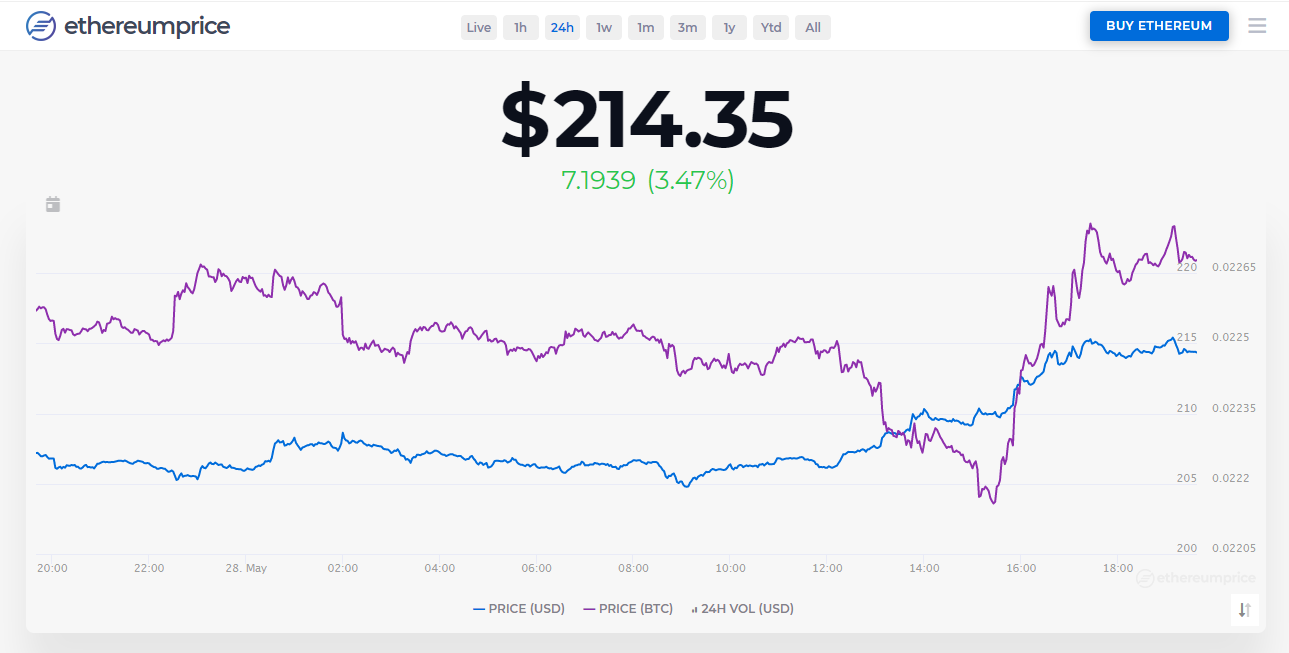

In the past 24 hours, data from ethereumprice.org has shown a more than 3% rally in the price of Ethereum with a net change above $8.30. Compared to other cryptocurrencies, ETH has made the most gains with Bitcoin also seeing similar gains at the time of writing.

Compared to its latest peak on March 12th, Ethereum has appreciated with what appears to be the beginning of a snowball picking up speed once again.

At the core of ETH’s price rally is the metrics of Ethereum’s daily gas usage. According to recent data, the Ethereum blockchain (now considered the most dominant force in the crypto world) has seen increased demand following an increase in the total gas used on the network.

Transactional fees on the Ethereum blockchain are measured in Gas and a recent report by Delphi Digital indicates a rising use of Gas on the network since the start of the year.

Unlike Bitcoin, Ethereum’s blockchain is designed with a fee structure that is somewhat detached from the price of ETH such that transactions and fees for generating smart contracts are determined by the price of gas and not the price of ETH.

The increased use of gas is a result of increased issuance of stablecoins to the tune of $4 billion not to mention the increased awareness and usage of Decentralized Finance application as a result of the popularity of decentralized exchanges.

Still, Bitcoin is leading the crypto charge.

In fact, Bitcoin has gained from ETH’s price rally as Wrapped Bitcoin (WBTC) on Ethereum now surpass $30 million since the year began. Furthermore, other Ethereum issued Bitcoin tokens are making headway as well.

However, with the increased use of Ethereum’s network, transactions with higher gas fees are increasingly prioritized by miners. Concerns have emerged that increased use of gas will reach the set limit per block thus slowing down the network.

A shift from the miner-reliant proof-of-stake algorithm to a proof-of-stake protocol in the near future with the launch of Ethereum 2.0 can solve this problem. At the moment, developers are still grappling with this problem with ongoing discussions on how to raise the cap on block capacity.

With Ethereum’s blockchain usage surpassing previous records, market analysts have determined that the cryptocurrency is “significantly undervalued” at its current price.

According to a series of tweets from Blockfyre (a crypto market analysis firm) even though ETH’s price continues to diverge further from key fundamental metrics, there exist strong indicators of ETH being a promising investment.

To find out how we use cookies, please read our cookie policy or click accept to continue.

Sign up for exclusive bonuses from Thecryptostrip